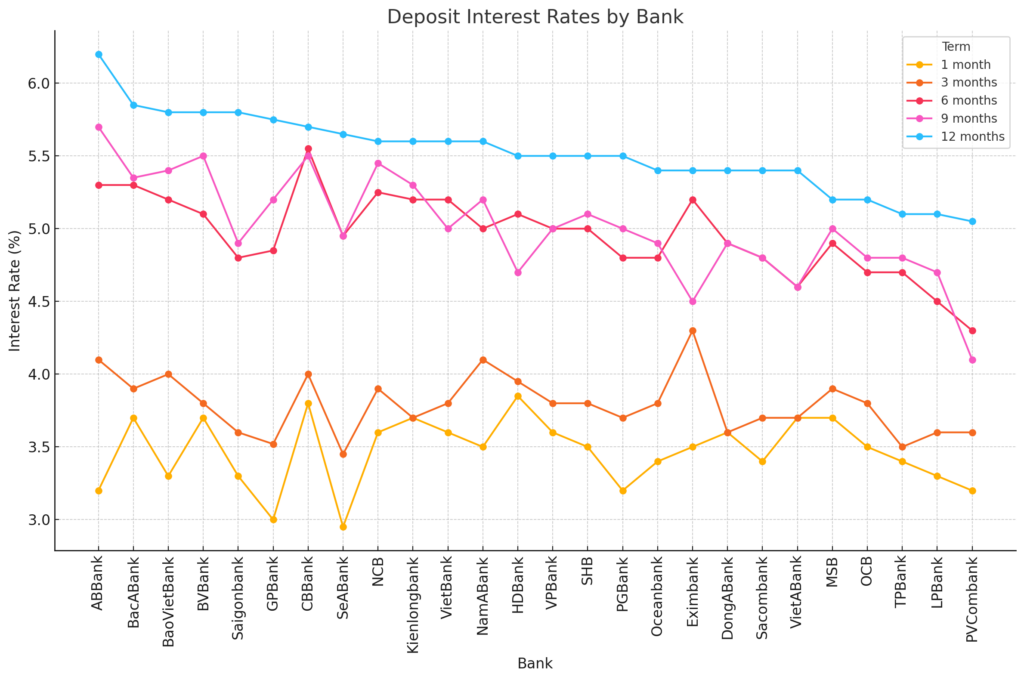

The Vietnamese banking sector is experiencing a wave of deposit rate increases, with multiple banks adjusting their deposit rate strategies recently. According to the latest reports, over the past month, more than 10 banks have raised their deposit rates, with increases ranging from 0.1 to 0.9 percentage points. Currently, the highest interest rate for 12-month deposits has reached 6.2%, setting a new recent high.

Banks participating in this rate adjustment include several well-known large private banks such as VPBank, Techcombank, ACB, Sacombank, TPBank, and SHB. Among these, Sacombank made the most significant adjustment, raising its 6-month deposit rate by 0.8 percentage points and its 9 to 12-month deposit rates by 0.5-0.6 percentage points.

Source: State Bank of Vietnam, compiled by Vanzbon

Other major banks have followed suit, increasing deposit rates for certain terms by 0.1-0.5 percentage points. Notably, ABBank currently offers the most competitive rate for 12-month deposits.

However, not all banks have adopted the same strategy. Smaller banks like SeABank and BacABank, which raised rates in July, chose to lower them last month. This differentiated approach reflects the varying circumstances and market positioning of different banks.

Looking at the overall trend, deposit rates in the Vietnamese banking sector have been on an upward trajectory since early April 2024, when the highest rate for 12-month deposits was around 5%. Since then, the number of banks offering rates above 5% has more than doubled, now reaching 29. This change clearly reflects the banking sector’s appetite for deposits.

In interviews, several bank executives stated that the main purpose of this round of rate hikes is to attract more deposits in anticipation of potential credit demand growth later this year. This strategy reflects the banking industry’s optimistic outlook on future economic development and demonstrates forward-thinking in terms of fund management.

Data from the State Bank of Vietnam shows that as of the end of August 2024, the national credit growth rate was approximately 5%, below the 14-15% target set at the beginning of the year. This data further explains why the banking sector is so proactive in raising deposit rates, aiming to gain an advantage in the potential rebound of credit demand at year-end.

Concurrently, the Vietnamese government is actively taking measures to stimulate credit growth. For instance, a series of policies have been recently introduced to support the development of small and medium-sized enterprises, including offering preferential loans and simplifying loan procedures. These measures are expected to gradually take effect in the coming months, driving the growth of credit demand.

In summary, two main points emerge:

1.Interest Rate Adjustment Trends:

- Multiple Vietnamese banks have raised deposit rates by 0.1-0.9 percentage points.

- The highest interest rate for 12-month deposits has reached 6.2%.

- The number of banks offering rates above 5% has more than doubled, reaching 29.

2. Banking Sector Strategies and Challenges:

- Large private banks generally raised rates, while smaller banks adopted varied strategies.

- The purpose of the increases is to attract deposits in anticipation of expected credit demand growth.

- Deposit growth is slower than last year, with some banks experiencing deposit declines.

Stay informed about Vietnam’s financial market dynamics and seize investment opportunities! Add and contact our senior advisor Jaycy to help you gain an edge in the rapidly changing Vietnamese market.